*Free Flash Report! RFS: RIN Generation Feb '25 Highlights

I will write a longer post next week for paid subscribers to tell more of a story what I think is going on. I also want to see what RIN prices do in the wake of the report.

Quick Highlights

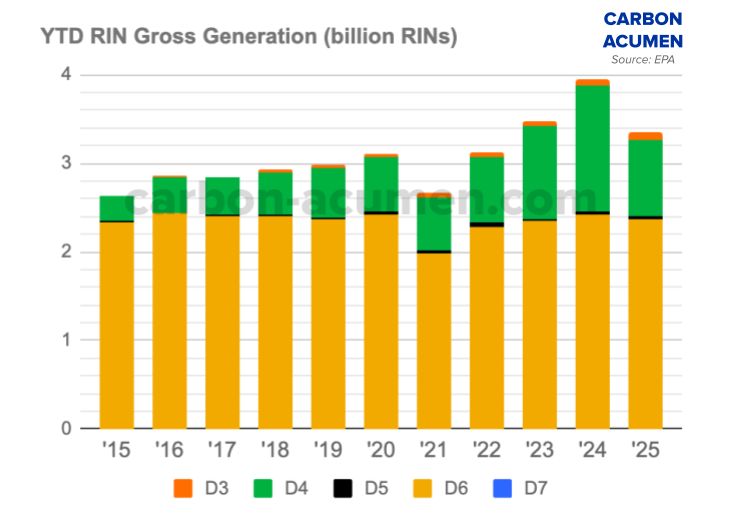

Gross RIN generation in February dropped to 1.52 billion RINs, the lowest levels not seen since February 2021 with the biggest fall coming from the D4 category.

D3 RIN gen: 7.5 million vs 80.8 million in Jan ‘25 (Jan revised up)

D4 RIN gen: 375 million vs 486 million in Jan ‘25

D5 RIN gen: 15 million vs 23 million in Jan ‘25

D6 RIN gen: 1,120 million vs 1,245 million in Jan ‘25

Total RIN gen: 1,518 million vs 1,835 million in Jan ‘25

YTD RIN Generation is now short of 3.4 billion RINs, which is below even 2023 levels in the first two months. Again obviously, the drop is due to D4 RIN generation (aka Biodiesel and Renewable Diesel).

D4 RIN generation dropped below 400 million RINs in February, the lowest level since January 2022 or roughly 2020 RIN generation volumes.

The sharp decrease in D4 RIN generation came from the large drop in Biodiesel and Renewable Diesel production.

And who said 45z was not a domestic policy? Foreign RIN generation from Biodiesel imports of production of Renewable Diesel has dropped to essentially 0 in 2025.

Although the impact of 45z along with the probable over-generation of Biomass-Based Diesel RINs in 2024 has caused domestic production to drop significantly due to poor economics.

Alright, that is it for now. I will be back next week to tell a more thorough story. Enjoy the tourney!