LCFS + Environmental Justice (part 2)

Are EJ groups speaking for the poor or starting to push policy for the rich?

(Note: no paywall for this article, it’s free for everyone)

This is the second part of a two-part article series. See part 1 here.

Philanthrocapitalism: Golden Ages

Historically the golden ages of philanthropy have after major capitalistic events. Money generated from capitalism and donated through philanthropy during these times have helped educate the poor and eradicate disease across the world utilizing the capitalists business problem solving skills geared towards solving societal issues.

Mercantile traders during the Renaissance

Joint-stock capitalism in the 18th century in the UK and Holland

Victorian era during the 19th century

Gilded Age Tycoons

The latter golden age occurred in the US driven by oil, banking, railroad, and tobacco tycoons such as Andrew Carnegie, John Rockefeller, JP Morgan, Leland Stanford, James Duke, Charles Schwab, Cornelius Vanderbilt which names are still commonplaces within US culture as many universities, banks, parks, buildings, and libraries bare their names.

The authors of Philanthrocapitalism point out we are in a new age of philanthropy, with the wealth concentrated by capitalists (and their families) after the rise of information and digitization. The capitalists are household names such as Bill Gates, Steve Jobs, Jeff Bezos, Michael Bloomberg, Hewlett Packard, Mark Zuckerberg, and Google. In fact the medium you are reading this on, Substack, is the part of the age information and digitization funded along by venture capitalists from Y Combinator and Andreessen Horowitz whose founder Marc Andreessen made his initial millions during the dotcom boom during the late 1990’s.

Just like the philanthropists before, todays wealthy elite are using their money, engineering & science backgrounds, business acumen and celebrity to help solve what they perceive as one of the world's biggest problems caused by burning fossil fuels: CLIMATE CHANGE.

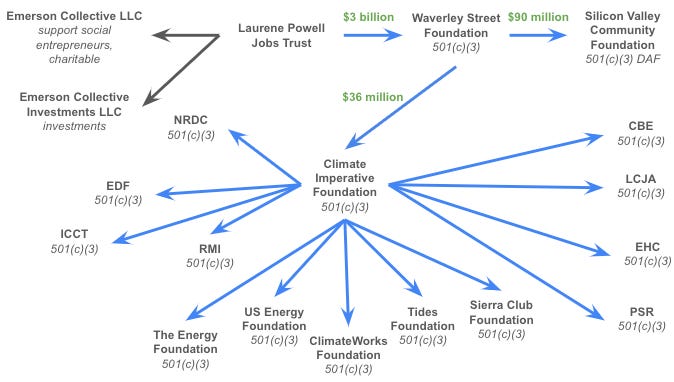

The Rise of Multi-Strategy Organizations & Structure

With the new rise of philanthropy and money, the structures within philanthropy have evolved to include layers of trusts, LLCs (aren’t subject to IRS annual giving mandates), foundations, and donor advised funds (DAFs) to get the best bang for the buck. For example Laurene Powell Jobs can donate billions of dollars from a trust to a foundation with $3 billion worth of Disney, Apple, Netflix and Snap stock almost tax free and then in turn hold investments within those organizations or make other investments with the money, also essentially tax free while donating money to various nonprofits and donor advised funds, again essentially tax free. Laurene Powell Jobs or Laurene Powell Jobs Trust is the CEO, managing member, or past board member of Emerson Collective LLC, Emerson Collective Investments LLC, Waverley Street Foundation, and the Climate Imperative Foundation. Therefore Laurene Powell Jobs can make a venture investment through the Emerson Collective Investments LLC as the Trust is the managing member, while funding various nonprofits to help push policy in favor of those investments as she is either the CEO or a former board member of Waverley Street Foundation (employs former CalEPA and EPA heads) and the Climate Imperative Foundation (funds various environmental groups, EJAC members, and a organization headed by a CARB board member). Millions can flow to donor advised funds, known as DAFs, such Silicon Valley Community Foundation which are not required to give a certain percentage of assets to nonprofits on an annual basis.

Other individuals have followed suit with the multi-prong approach of donating money while making investments such as Nest founder Matt Rogers (incite.org) and VC Angel investor Chris Sacca (Lower Carbon Capital).

Environmental Groups Undisclosed Investments

The LCFS Nonprofit Collective along with the smaller foundations (The Energy Foundation, US Energy Foundation, ClimateWorks Foundation, Tides Foundation, Sierra Club Foundation) received a total of $400 million in total in 2021 alone from multiple Bay area foundations (Waverley Street Foundation, David and Lucile Packard Foundation, William and Flora Hewlett Foundation), Bloomberg Philanthropies, and large donor advised funds (Silicon Valley Community Foundation, Fidelity Investments Charitable Gift Fund). Waverley Street, Packard, Hewlett, Bloomberg, SVCF, and Fidelity nonprofits have a total of over $103 billion in assets where 95+% of the assets are in investments.

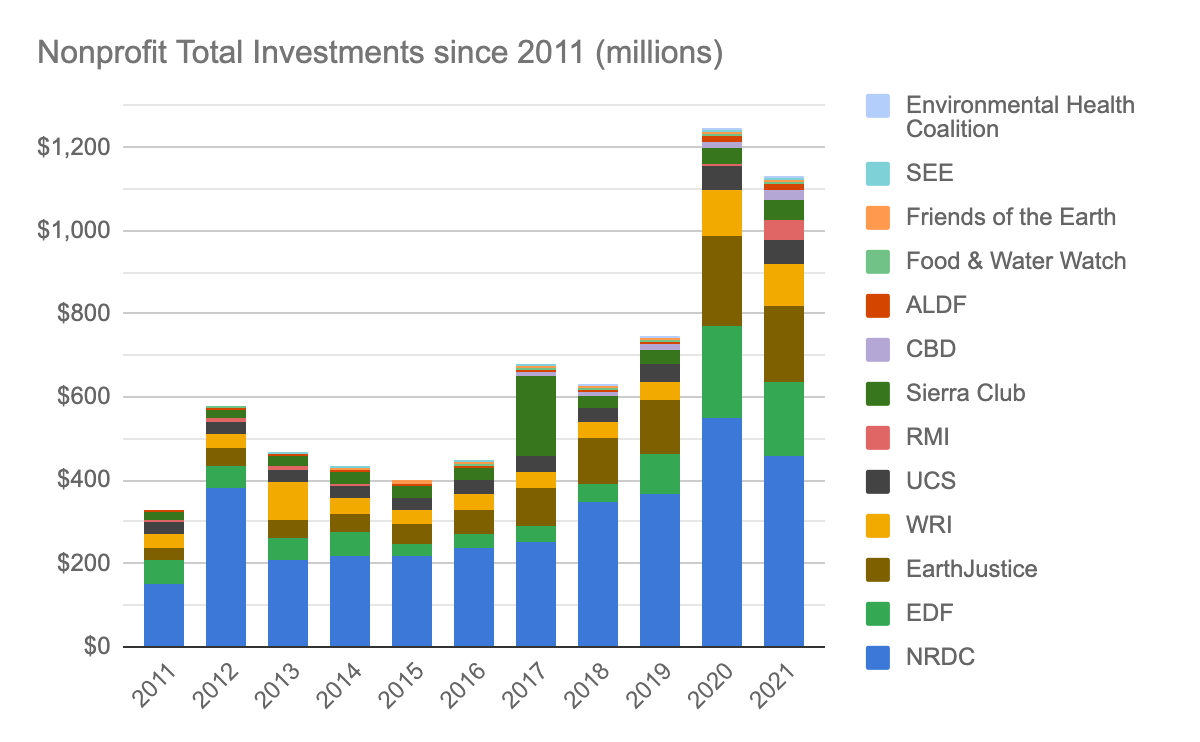

Investments held by the LCFS Nonprofit Collective have grown to over $1.1 billion since 2011 with the majority of investments held by Natural Resources Defense Council (NRDC), Environmental Defense Fund (EDF), EarthJustice, World Resources Institute (WRI), Union of Concerned Scientists (UCS), and Rocky Mountain Institute (RMI).

What do these investments include? The nonprofits do not have to state what specific publicly traded securities or other securities they hold.

Foundation & Trust Investments

Waverley Street Foundation initial backing primarily came from Disney, Apple, Netflix, and Snap stock. However the foundation now holds other investments including $650+ million of OHA Delaware Customized Credit a pooled investment fund which is managed by Oak Hill Advisors LP. According the latest SEC 13F filing, Oak Hill Advisors LP main public securities are in oil and gas such as $565 million in Valaris (offshore drilling) and $315 million in Expro Group Holdings (offshore drilling exploration). Waverley Street Foundation also holds $340+ million in Purpose Alternative Fund F LLC which is managed by Magnetar Financial LLC based out of Evanston, Illinois. Magnetar Capital, also located in Evanston and shares the same address as Magnetar Financial LLC, invests into Permian Basin oil & gas exploration. It is unclear whether the specific funds held by Waverley Street Foundation held other assets not mentioned.

The David and Lucile Packard Foundation stopped reporting individual assets in 2013 (link) but at the time held over $428 million in two MSCI Blackrock index funds. It is unclear what securities the specific Blackrock funds had in 2013 but they now include international oil companies such as Shell, Total, Reliance Industries, PetroBras, and PetroChina. It is likely the Blackrock funds had some sort of international oil & gas investment exposure in 2013.

The Bill & Melinda Gates Foundation Trust investments reads like a slice of the world economy which includes oil & gas stocks and bonds such as $10 billion in Berkshire Hathaway alone (Occidental Petroleum, Chevron), China Oilfield Services, ExxonMobil, Madison Square Garden Sports, 3M, ConocoPhillips, PNC Financial, Delta, Halliburton, McDonalds, and the list goes on and on and on…

Offshore Money, Non-Employee Management Fees

The David & Lucile Packard Foundation at the end of 2021 held $100 million into Perento Fund Limited fund located in the Grand Cayman Islands. Since 2011 the David & Lucile Packard Foundation has received over $280 million from funds located international tax havens such LACV Limited, Activum SG Feeder Fund I C LP, Valarc Offshore Fund, Ltd., and PackPar Fund.

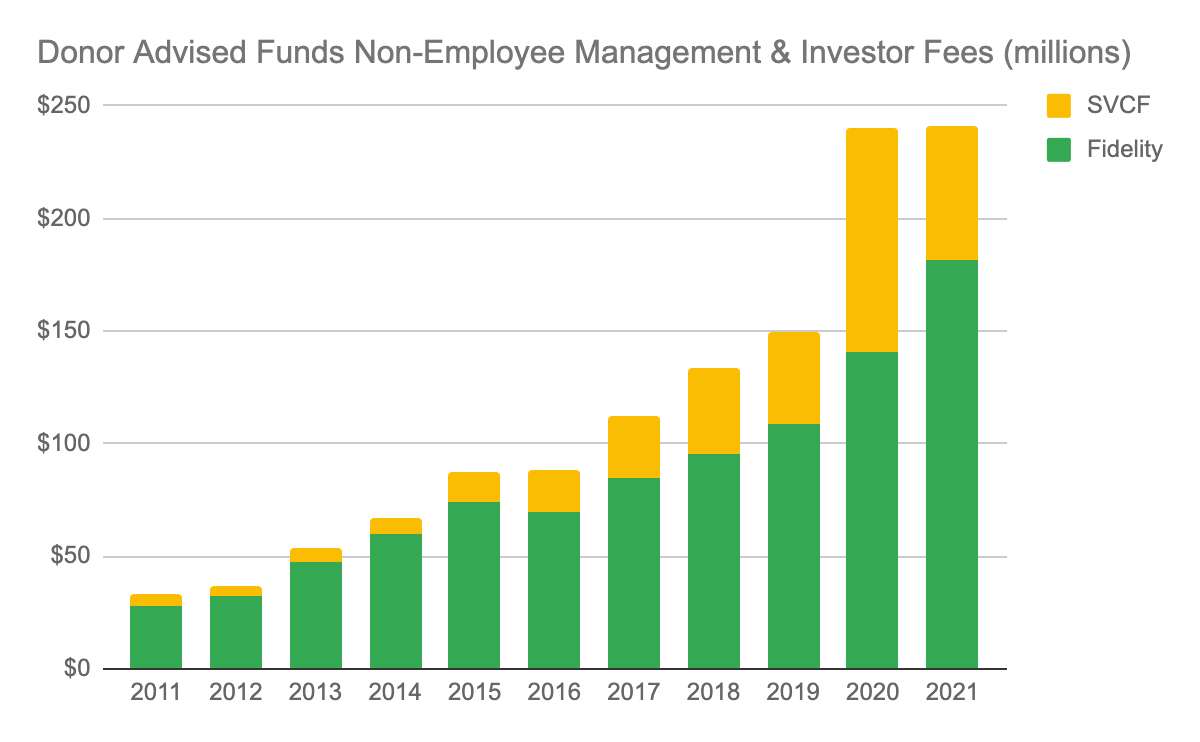

Most of the foundations, funds, and trusts pay a modest management and investment fee(s) to an internal workforce or outside banks such as Goldman Sachs, Bank of New York Mellon, and JP Morgan. However non-employee management and investment fees for donor advised funds like Silicon Valley Community Foundation and Fidelity Charitable Investments Gift Fund have ballooned to nearly $250 million annually.

Legislation to look under hoods of the donor advised funds (DAFs) has been considered multiple times in recent years in California under AB 1712 and AB 2936 but did not get to the Governor’s desk due to stalling out in the Assembly or Senate. And these bills were opposed by Silicon Valley Community Foundation and Fidelity in which latter pays the bulk of those non-employee management & investor fees to FMR LLC whose CEO is Abigail Johnson, a board member of Breakthrough Energy Ventures.

FMR LLC has over $1.1 trillion in assets under management (AUM) including hundreds of millions into the billions in each of Chevron, Valero, Marathon, and P66 along oil & gas companies. Fidelity Charitable Investments Gift Fund also holds over $1.3 billion in international tax havens such as British Virgin Islands, Grand Cayman Islands, Jersey, and Guernsey.

Venture Investments

Current and former Climate Imperative Foundation board members include individuals who are investors or sit on the boards of multiple venture funds such as S2G Ventures ($2+ billion AUM), Breakthrough Energy Ventures ($2+ billion AUM), and Emerson Collective ($20+ billion AUM). Breakthrough Energy Ventures received $1 billion from the University of California in 2015 and their board and investors includes the wealthiest American and international individuals and families including the Walmart Waltons, Jack Ma, Michael Blomberg, Abigail Johnson (board member), Masayoshi Son, Ray Dalio, Vinod Khosla (board member), Bill Gates (board chair), John Doerr (board member), Jeff Bezos, John Sobrato (co-owner of the 49ers), Richard Branson, Chris Hohn, David Rubenstein, and Mukesh Ambani (board member).

Many of these venture funds invest into new clean tech companies alongside each other and major international oil companies.

Electric Hydrogen (hydrogen from water, renewable electricity)

Investors: BP Ventures, Breakthrough Energy Ventures, S2G Ventures, Equinor Ventures (Norway oil company), Cosan Ventures (also owns Raizen in Brazil via JV with Shell)

Form Energy (long duration battery storage)

Investors: Saudi Aramco, Eni Next (Italian oil company), Breakthrough Energy Ventures, Fidelity Management & Research (FMR)

LanzaJet (alcohol to SAF + Renewable Diesel)

Grants: Breakthrough Energy Ventures, US DOE

Investors: Shell Oil, Suncor Energy, Mitsui & Co, Microsoft Climate Fund

Mainspring Energy (linear generator from hydrocarbon source)

Grants: BloombergNEF

Investors: Chevron, Equinor, Khosla Ventures, Shell Ventures

Orange EV (EV drayage)

Grants: Kansas Dept of Commerce

Investors: S2G Ventures

Redwood Materials (lithium ion battery recycling)

Investors: Breakthrough Energy Ventures, Emerson Collective, Microsoft Climate Fund, Amazon, Fidelity

Sierra Energy (MSW gasification to electricity, H2, RNG, Ammonia)

Grants: California Energy Commission, US DoD

Investors: Breakthrough Energy Ventures, BNP Paribas

Twelve (jet fuel from CO2, water, renewable electricity)

Grants: BloombergNEF, National Science Foundation

Investors: Chan Zuckerberg Initiative, Microsoft Climate Fund, Emerson Collective

WeaveGrid (EV data for utilities)

Investors: Breakthrough Energy Ventures, Emerson Collective

ZeroAvia (aircraft hydrogen fuel cell)

Investors: Breakthrough Energy Ventures, Shell Ventures

EJAC Recommendations for LCFS

During the combined EJAC/LCFS Board meeting in September, EJAC recommended the following:

Conduct full life cycle assessment (LCA) of all air pollution and GHG emissions for all pathways and implications for EJ communities.

Conduct full GHG and air pollution emissions related to fuel from livestock and dairy manure

Eliminate avoided methane credits starting Jan-2024

Eliminate credit generation fuel from livestock and dairy manure

Cap the use of lipid biofuels to 2020 levels

Prohibit enhanced oil recovery as eligible sequestration method

Do no issue LCFS credits for carbon removal projects (Direct Air Capture)

Consider the inclusion of intrastate jet

EJAC also called on CARB to reform the LCFS to strengthen support for zero emission vehicles including mass transit, drayage, and heavy duty trucks.

These recommendations have also been fully or partially supported by other nonprofits such as NRDC, EarthJustice, Food & Water Watch, and Animal Legal Defense Fund.

Old Dog, New Tricks, Unclear Motivation

Investing money into infrastructure assets & projects out the front door while donating money to a nonprofit to influence policy in your favor out the backdoor is nothing new. The ethanol, biodiesel, renewable diesel, renewable natural gas, and oil refining industries have done it through industry trade groups for years such as Renewable Fuels Association (ethanol), Clean Fuels Alliance America (biodiesel, renewable diesel), RNG Coalition (renewable natural gas), Western States Petroleum Association (oil refineries), respectively. And advocating through local smaller groups has been down before too, known as ‘Astroturfing’. However the combination of what appears to be a potential grassroots astroturfing campaign by the wealthiest Americans to influence energy policy such as LCFS while investing billions into energy assets & infrastructure, is something new.

The motivation behind all this movement of money is murky and unclear. Is it to give poorest California communities a voice? Or is it for a big tax break for the wealthiest Americans while they jetset around the world claiming to care about climate change and the poor? Or is guilt the underlying motivator as the wealthiest Americans invest into new technologies alongside the largest non-American multinational oil companies in the world? Or is it a way for to slow progress for competition and take market share? Or is it something more sinister laying the groundwork for a plutocracy where the first generation of family creates a groundbreaking company then sets up assets in mirage of trusts, LLCs, and foundations to avoid taxes as their family reap the benefits almost tax free, gain more political power as they donate millions into billions to politicians and nonprofits to influence policy in favor of their investments? Or is it all the above?

Thanks for this. Very interesting!