Q: Who called this record bank build and record breaking CI reduction progress?

A: CARBON ACUMEN did in 2022.

I set up the rest of this piece highlighting the things that I absolutely nailed and things that I was slightly off with but was directionally right. Is this arrogant to do? Nope, it is showing confidence in my work. There’s a fine line between confidence and arrogance and I tend to nimbly walk that line.

CI Reduction & LCFS Credit Bank

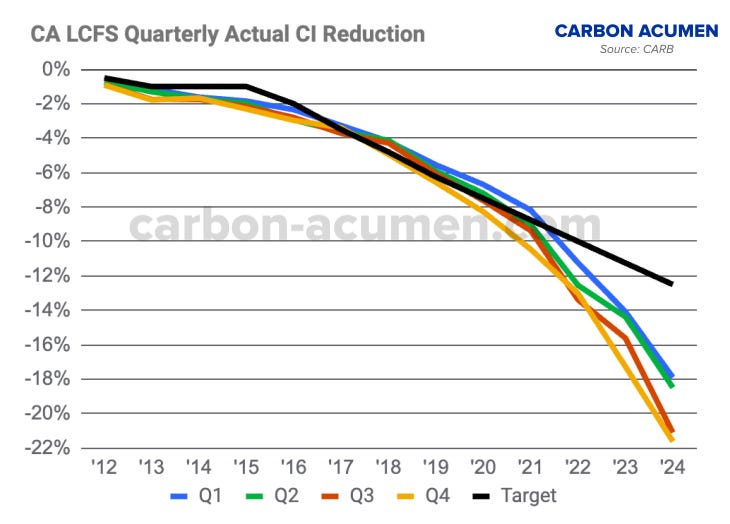

“…Recent LCFS transfer value explosion of $14 billion in the past 4 years has led to a flurry of investments in a pre-COVID world into low carbon fuel production and downstream infrastructure into some of the highest credit generating fuel sources such as livestock digester buildout in the San Joaquin Valley for CNG use within the state along with major US refiners expanding renewable diesel production. The tsunami of credit generation from the growth in Renewable Diesel (RD), electricity, and livestock anaerobic digesters (RNG) coupled with COVID gasoline demand destruction puts the LCFS program in a great situation to increase pre-2030 CI reduction targets as the 2030 CI reduction target of 20% is forecasted to be achieved in 2024, a full 6 years ahead of schedule…”

Like in past years, Q4 is typically the lowest CI reduction quarter.

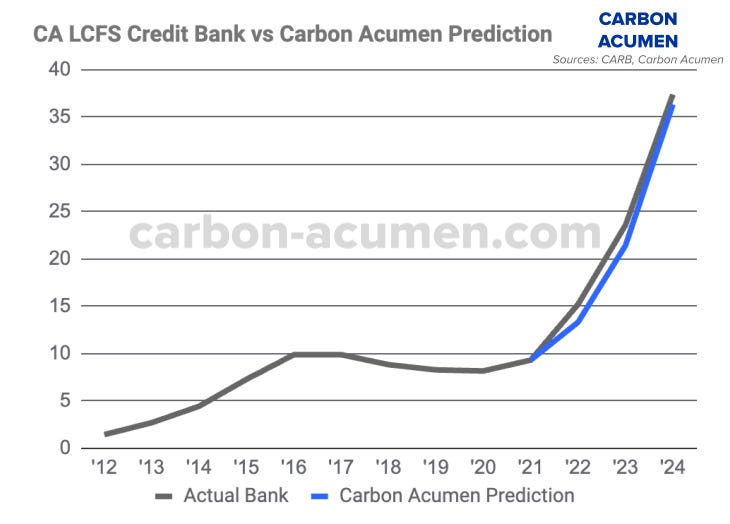

“…The respective LCFS credit bank is forecasted to quadruple from over 9 million MT in 2021 to over 36 million MT by the end of 2024…”

Is CARB going to get the LCFS rule-making final to slow down the growth of the credit bank? The bank is now over 37 million MT.

LCFS prices rebounded back in the mid-$60/mt range in Q4 but prices are now sub-$60/mt as of this piece as there are 6+ quarters worth of deficits in the bank, an all-time record.