All sorts of new things in the modified text update CARB dropped Monday afternoon. The main topics due to the changes in the regulation text are:

Step Down Harder in 2025, Keeps Ratchet (AAM)

-CI RNG Stays

Residential EV Charging Credits to OEMs

OPIS Ethanol Benchmark Going to Change?

Biomass Based Diesel Feedstock Limitations

Biomass Sustainability Criteria

No Jet Obligation

Step Down & Ratchet

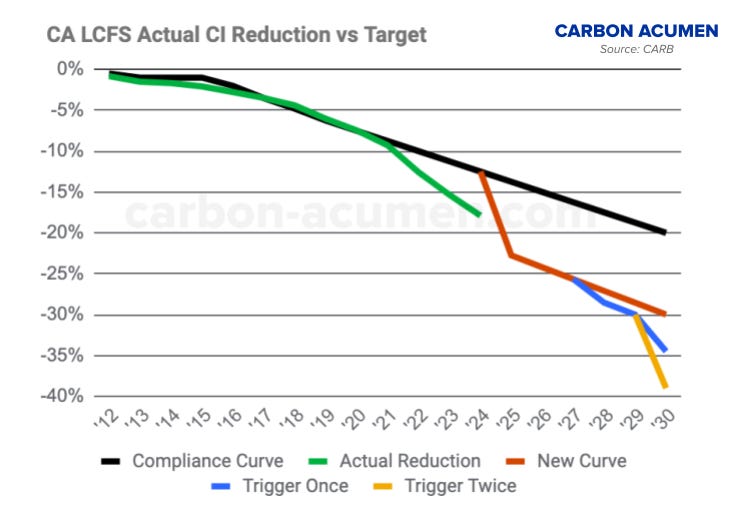

CARB went harder in 2025, dropping an additional 9% from the current 13.75% target to 22.75% starting next year. The current CI reduction target in 2024 is 12.5% while actual CI reduction in Q1 came in at around 18% leading to a gap of nearly 5% gap between Q1 2024 and 2025. CARB has also kept the two-test methodology to trigger the ‘Ratchet’ or AAM. The earliest year the ‘Ratchet’ can pull forward is 2028 compliance and onwards. The ‘Ratchet’ can only be triggered every other year. The two-test metrics for the triggering of the ‘Ratchet’ are below. If the ‘Ratchet’ were to trigger twice, the 2030 CI reduction target would move from 30% to 39%.

Quarters worth of Deficits in the Bank > 3 quarters

Prior year Credits > Deficits

Since LCFS credits do not expire, the cumulation of credits not retired for obligation stay within CARBs LRT system. And the aggregate of the credits in all the accounts is known as the ‘Credit Bank’. Not one entity owns the bank and neither does CARB. Historically credit prices fall when there are >3 quarters worth of deficits in the bank. Thus the thinking behind the two-test methodology to pull forward the compliance curve by on year by assuring obligated parties there are enough credits in the bank just in case the program becomes too stringent.

-CI RNG Stays

After all the fighting between EJs and the Dairy digester groups, nothing major changed. Book-and-claim has to show physical flow to California by Jan 1, 2038 but CARB must approve a pipeline map:

“…Notwithstanding the above, if the Executive Officer approves a gas system map by July 1, 2026, to support implementation of deliverability, then the entity reporting under bio-CNG, bio-LNG and bio-L-CNG pathways for CNG vehicles must demonstrate the physical flow listed above after December 31, 2037. The Executive Officer will only approve a gas system map if it includes identification of transcontinental and connected pipelines posted on a local, state or federal government website, for which the gas flows to CA at least fifty percent of the time on an annual basis, and will be based on directional flow data from 2020 to 2023…”

Break ground on a new facility before Jan 1, 2030, avoided methane crediting can only last up to 20 years. Break ground after roughly Jan 1, 2030, avoided methane crediting only lasts until 2040 for NG and 2045 for biomethane to electricity pathways.

Residential EV Charging Credits

Base residential EV charging credits historically have gone to utilities in a roundabout way based on the number of EVs in each respective jurisdiction and an average EV utilization rate. CARB used to use data from roughly 1,500 vehicles to find an avg kWh utilization every quarter, then applied average to total and dealt out LCFS credit to the respective utilities based on the number of EVs in its area. But now the number of vehicles used to come up with the avg utilization rate every quarter is 650,000+ vehicles, thus more accurate. Credits then go to the utilities, then in turn they held public auctions to sell the LCFS credits. However the utilities are not allowed to spend the $$ all willy-nilly, there have been limitations put in place on the utilities by the CPUC and CARB. Utilities have to get approval for project spending with the goal of furthering ‘electrification’ whether that is for infrastructure capex, marketing, on educational purposes. Through 2023 roughly $1.4 billion worth of LCFS credits via residential EV charing have been created and sold.

One of the programs in which utilities can spend LCFS credit $$, approved by both CARB and the CPUC, was the Clean Fuel Reward Program. Over $416 million went to dealerships as rebates for ZEV purchases. However, there was NO INCOME LIMIT specification placed on the rebate. And because Tesla is also the dealer, they received a staggering $275 million under the Clean Fuel Reward Program. Millions went to subsidize $100+k vehicles such as the Model S, Porsche Taycan, BMWs, and Audis purchased by some of California’s wealthiest individuals. The California Clean Fuel Reward Program ran out of money. Shocker! Look at the graph, you can’t even see the bars for the others!

Now auto OEMs have the ability to receive 45% of the base credit with the same limitations utilities have - spend it on furthering electrification.

“…The Executive Officer may direct up to 45% of base credits to eligible OEMs, if the share of new zero emission vehicle sales for model year 2024 zero emission vehicles certified under California Code of Regulations, title 13, section 1962.2 is less than 30 percent…”

Current LDV sales are less than 30% in 2024. The money does come with serious ties such as reporting to CARB the LCFS trade price, the money received, a summary detailed list and explanation of admin costs for program related marketing, education, and outreach activities, etc, etc, etc.

OPIS Ethanol Benchmark Going to Change?

With the drastic drop in the gasoline CI compliance curve, there could be a slight shakeup in the ethanol world. The OPIS ethanol benchmark of 79.9 CI now starts generating deficits in 2025. The 79.9 CI benchmark stems from the original 90.1 CI benchmark of “midwest corn ethanol” back in the early days of the LCFS program. Then in 2015 CARB dropped the LUC of corn ethanol by 10.2 CI points. And for some reason OPIS set an arbitrary benchmark for ethanol producers to give away CI points for free at the helm of obligated parties. There wasn’t a single ethanol CI pathway with a score of 79.9 nor were gallons with a CI score over 70 shipped to the state. What will happen going forward? Who knows.

Biomass Based Diesel Feedstock Limitation

Alright now for the meat. Per the text, CARB put in a credit generator cap on Soybean Oil and Canola Oil of 20% per company. Any volume over 20% does not generate a credit or deficit.

“…Biomass-based diesel produced from soybean oil and canola oil is eligible for LCFS credits for up to twenty percent combined of total biomass-based diesel annual production reporting, by company. Any reported quantities of biomass-based diesel produced from soybean oil or canola oil in excess of twenty percent on a company-wide basis will be assigned a carbon intensity equivalent to the carbon intensity benchmark…”

However the 20% seems to be a moving target. If production goes up so does the cap. Right now based on current BBD volumes, the BBD cap in aggregate would be set at about 120 million gallons per quarter in which roughly 50-75 million gallons of BBD went over the 20% mark.

Most of the SBO+Canola BBD volume being over the 20% cap comes from RD.

Intermittently some biodiesel volume goes over the 20% cap.

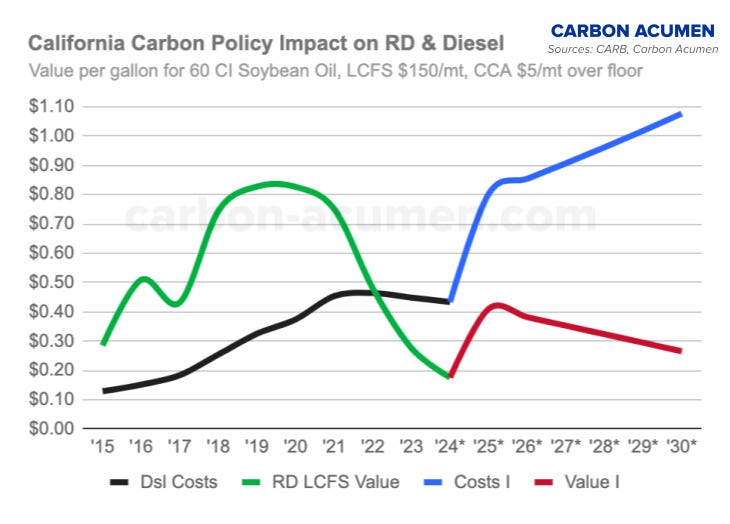

But do these caps really mean much? Eh, I don’t think so as the compliance costs of selling diesel into California now outweighs the LCFS value on a gallon of RD. Obligated parties are switching one fuel (CARB Diesel) with another fuel (RD).

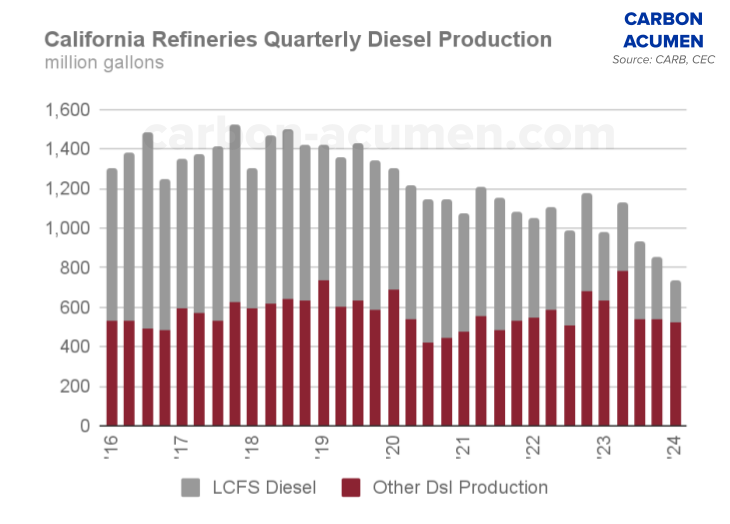

California refineries are still making diesel but it is going elsewhere as only 29% of diesel production within the state winds up with LCFS obligation (an indication of also not having C&T obligation). Essentially obligated parties in California are fuel switching, bringing in RD or producing it in state and shipping out conventional diesel to avoid obligation under LCFS and C&T (RFS too if the volumes were exported out of the country).

What is it being replaced with? Well RD of course.

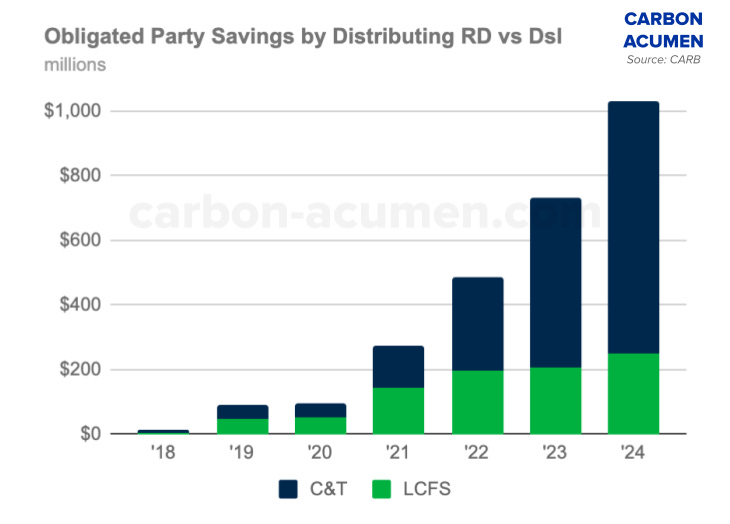

If you distribute conventional diesel in the state of California, you not only generate obligation under LCFS but also Cap & Trade (C&T). Meaning you have to buy LCFS credits and California Carbon Allowances, known as CCA’s, if you distribute conventional diesel. And because distributing RD into the state gets hit with a tiny amount of C&T obligation vs distributing conventional diesel, obligated parties have been able to lower their quarterly C&T obligation due to fuel distribution by 25+%.

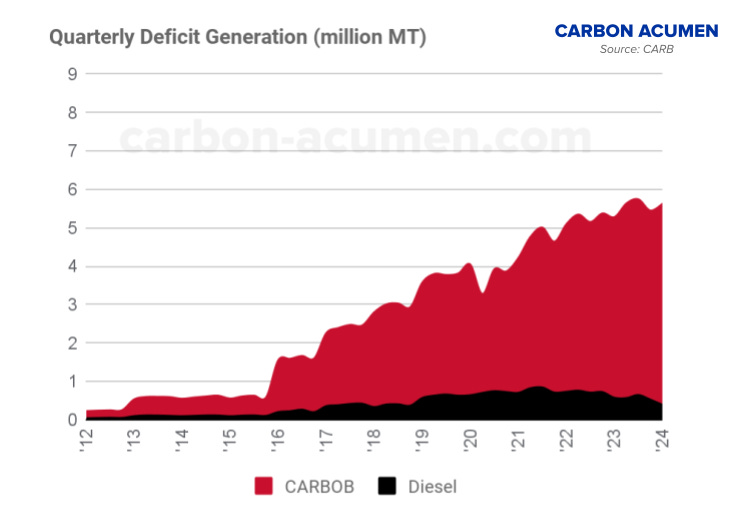

Obligated parties have also been able to keep LCFS deficit generation below 1 million MT per quarter, essentially at the same levels from 5 years ago even though the program has become more stringent, meaning more deficits are created per gallon of diesel.

By doing this fuel switcharoo, obligated parties have been able to save $2.7 billion since 2017 ($725 million alone in 2023) by buying less LCFS credits and CCAs. If RD blends stay the same throughout 2024, obligated parties are looking to save $1+ billion, again from not having to buy fewer California carbon policy credits (LCFS, CCAs).

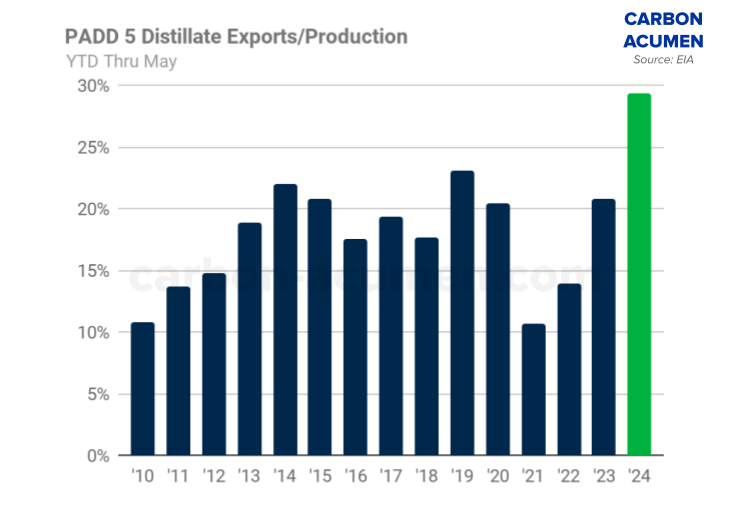

This is not just a California thing, with LCFS like programs being prevalent from California to Washington, PADD 5 diesel consumption has dropped harder than production since the beginning of 2022.

Diesel net exports out of PADD 5 have risen back to pre-pandemic levels.

And exports as a percentage of production is at all-time highs through the first five months to just under 30% in 2024.

Looking ahead with both Cap-and-Trade and LCFS undergoing a rulemaking process, I ran through two different scenarios with regard to SBO RD (60 CI) based on the new LCFS CI curve and CCA (C&T environmental attribute) potential prices, along with their impact on the cost of diesel. And as you can see, the arbitrage widens significantly with the SBO RD LCFS value only coming out to be $0.10-$0.40 per gallon, enough to pay for feedstock or fuel transportation to California. Depending on the price of the credits, California’s carbon policy costs on a gallon of diesel is looking to cost between $0.45 to $1+ per gallon through the end of the decade.

Scenario I: LCFS price $150/mt, CCA price $5/mt over price floor, no AAM trigger

Scenario II: LCFS price $50/mt, CCA price at floor, no AAM trigger

In order for RD not to make sense in California, RD producers whom are obligated parties need to start losing $0.50+/gallon on the fuel, maybe more. As long as RD production is netting out at a lower loss than the cost of additional credits needed to purchase from distributing conventional diesel, obligated parties will ship RD into the state no matter the feedstock (assuming there is not another market in similar size to California where shipping RD is highly more profitable).

Still not making sense? If you are running a business, you try to maximize revenue and/or minimize cost. RD in California has undergone a paradigm shift from making $2-$3/gallon or into the billion of profits to a clear way to lower costs by the billions for obligated parties (potentially making money too).

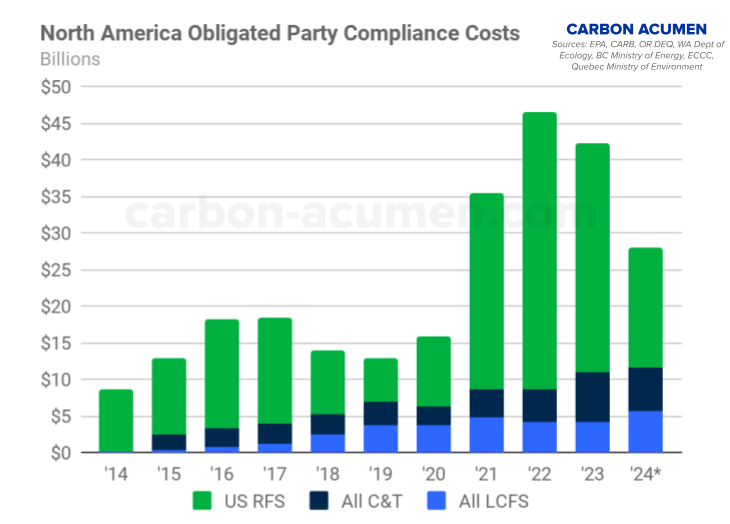

Due to this paradigm shift within the market it seems feedstock caps for RD credit generation likely won’t dramatically change the pull on Renewable Diesel, and even might pull harder for RD use in the state due less credits being generated, thus higher LCFS prices, thus higher costs on conventional diesel. Renewable Diesel in California is the easiest way for major obligated parties to comply with multiple programs with one fuel in one location while spending billions of dollars annually less on California carbon policy credits on top of fewer RIN purchases for compliance under the US RFS. By over complying with said programs, the entire ‘compliance market’ cost structure comes down. What starts in California tends to spread. If you apply the same methodology across all the LCFS, C&T, and RFS programs in North America, as what appears the obligated parties have done, the entire cost structure comes down. Although obligated party spending to comply with these programs has nearly doubled since 2020, the cost of compliance has dropped in the short-term by $15 billion-$20 billion per year.

(note: C&T costs below are only on the distribution of fuel, not the entire cost of the programs)

Biomass Sustainability Requirements

CARB changed language from crop/forest based to the term ‘biomass’ with respect to sustainability requirements. Some changes in the regs (pages 171-176):

All biomass from point of origin must be certified according to the phase-in implementation. If not certified the fuel generates deficits as it hit with a CARBOB or CARB Diesel CI.

Biomass used in fuel pathways must only be sourced on land cleared or cultivated prior to 2008.

Starting in 2026, pathways utilizing biomass must use geographical shapefiles to plot boundaries or coordinates of farms. Coordinates must be submitted in a fuel annual report using latitude/longitude or the Universal Transverse Mercator coordinate systems.

Jet Stays Exempt, Future Mandate is Possible

Making jet fuel obligated under the LCFS program was the biggest potential upcoming legal battle with CARB. WSPA, Chamber of Commerce, and the airlines all wrote in during the comment period stating that CARB did not have the legal authority to make it obligated under LCFS as jet fuel compliance lies under the EPA, not CARB. Even the airlines pouring money into SAF production such as Southwest and American Airlines also objected to CARB making jet fuel obligated under LCFS due to raising jet fuel costs as its one of the biggest operating expenses incurred by a low margin industry.

However CARB did release a California Aircraft and Airports Fact Sheet in July. CARB is teaming up with South Coast AQMD and the EPA looking into how to make ground support equipment (GSE) zero emissions through a possible Indirect Source Rule (ISR). CARB also left the door open for some sort of SAF mandate due to lowering PM emissions by 65% vs conventional jet but it is unclear how they could do so without the help of the EPA.

Is there a reason why you’re aggregating the “other” category along with canola and soybean oil when calculating current feedstock usage relative to the 20% canola + SBO cap?

Is it fair to assume that everything in the “other” category also comes from soy and canola? I haven’t seen this explicitly anywhere, but had a suspicion it was the case…

In regards to ethanol, are the changes more likely to potentially help or harm ethanol producers?

Since corn oil is not capped. Is this likely to significantly increase the price of corn oil moving forward by giving it an advantage over other feedstocks?