January Gross RIN Generation

RIN generation in January dropped to 1.76 billion RINs, the lowest levels not seen since Q1 2023 with the biggest fall coming from the D4 category.

D3 RIN gen: 8.6 million vs 7.2 million in Jan ‘24 (Dec revised up to 178 mill)

D4 RIN gen: 486 million vs 676 million in Jan ‘24

D5 RIN gen: 20 million vs 18 million in Jan ‘24

D6 RIN gen: 1,245 million vs 1,206 million in Jan ‘24

Total RIN gen: 1,760 million vs 1,907 million in Jan ‘24

January was the 2nd largest YoY drop for the month in the past decade only to fall behind 2021 - ya know, the pandemic.

D3 Continues the Climb…Sorta

D3 RIN generation continues the climb upwards with December being the highest RIN generating month in the programs history. D3 RIN generation recorded as “January” was also the highest January D3 RIN generation on record.

Although the run rate has spiked over the course of 2024, it is still far below what is needed to hit the 2025 RVO of nearly 1.38 billion RINs.

And it looks as if 2024 D3 RIN generation came in short of the 1.1 billion 2024 RVO even though it had the largest growth year in the programs history.

D4, D5, D6 RIN Generation

D4 RIN generation in January was 486 million RINs, the lowest month since October 2022. The drop of 421 million RINs vs December came from the combination of Biodiesel (-208 million RINs vs Dec) and RD (-230 million RINs) with the slight rise in Jet (+17 million RINs). More on this later in the article…

D5 RIN generation was slightly lower in January only dropping about 7 million RINs vs December with the largest fall in RD.

D6 RIN generation remained strong in the month with 1.245 billion RINs being generated coming all from corn ethanol showing there is not a slowdown in ethanol production as exports hit an all-time high in 2024 at around 1.9 billion gallons (1 ethanol gallon = 1 RIN).

Just a reminder to everyone nearly 100% of the RINs generated from Biomass Based Diesel (BDD) - the combination of Biodiesel (Bio) and Renewable Diesel (RD) - are within the D4 category.

And the RINs which are not within the D4 category are now mainly RD RINs within the D5 (Advanced), generating about 5-10 million RINs per month. D6 RIN generation from with RD or Bio are ‘grandfathered’ in production facilities using palm oil as the feedstock.

Elephant (Herd) in the Room…RD, Bio, SAF

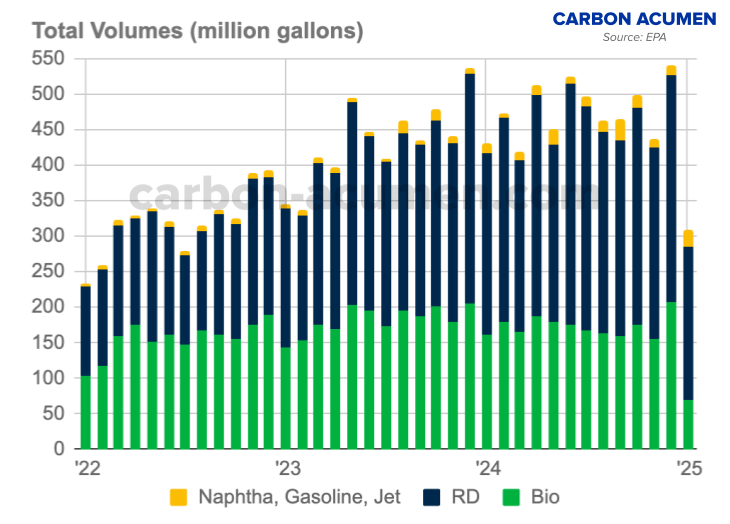

BBD volumes in January hit the lowest levels since mid-2022 at just over 300 million gallons.

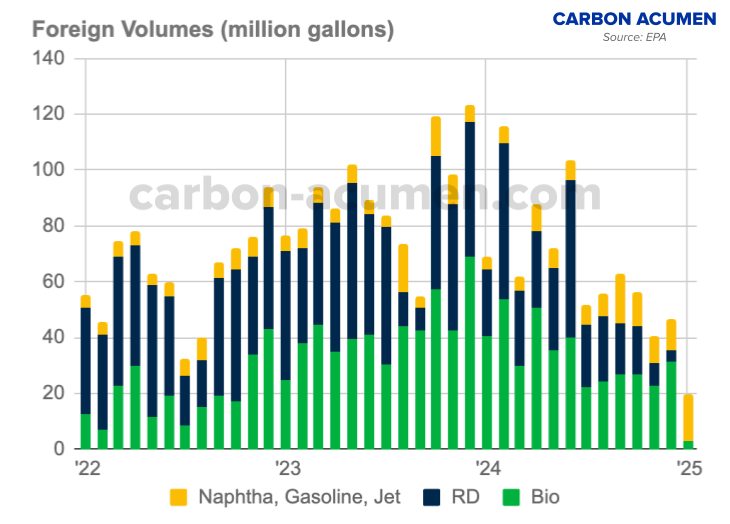

Foreign volumes completely fell off the map to 20 million gallons with the #1 volume not being RD or Bio. RD laid a big fat goose egg while Bio imports fell to 3 million gallons in the month, the lowest amount since early 2014.

Why did foreign RD RIN generation lay a goose egg in January? Up until recently, Neste has accounted for nearly 100% of the RD imports into the US and their RD margin has tanked by roughly 70% as US RD producers have taken market share.

With falling margins, Nestes’ stock is back to essentially where it was 10 years ago. FYI - SP500 has essentially 3x in the same time period.

The other importer of RD, Braya in Canada, shut down production of their facility in Newfoundland due to economic conditions and plan to open back up when margins improve.

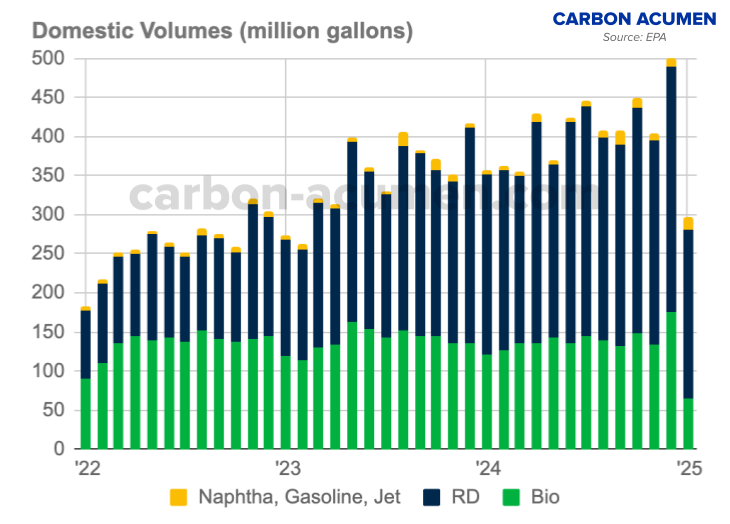

Not only did foreign volumes fall but so did domestic volumes. Domestic BBD volumes fell to under 300 million gallons in January for the 1st time in 2 years.

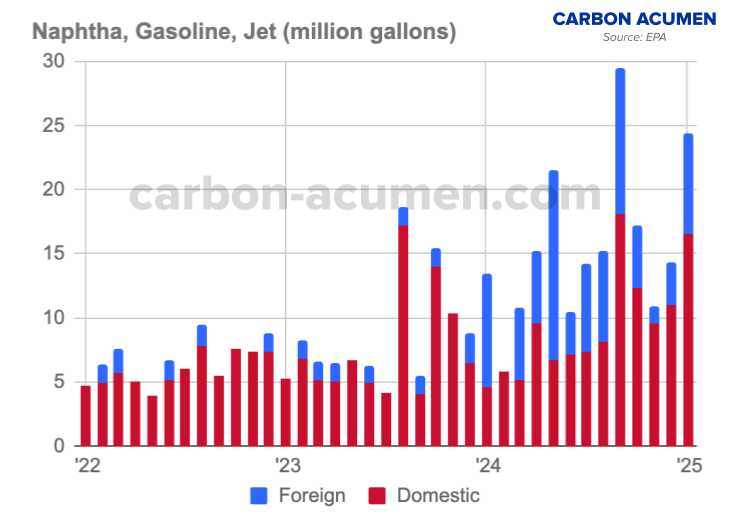

Don’t forget Valero/Darling switched over part of the Port Arthur facility to make SAF for the international market as they took about 10 kbpd offline from RD to SAF, the equivalent of 12-13 million gallons per month or about 150 million gallons per year.

“…We had about 10,000 barrels a day of Renewable Diesel from Port Arthur that was going to our wholesale channel that we were selling. That material is now going to produce sustainable aviation fuel…”

-Gary Simmons (Valero, EVP & COO)

“…the most attractive (RD/SAF) markets are going to be in Europe and Canada compared to U.S. and California…foreign UCO no longer qualifies for domestic RD. Our foreign UCO is and has always been pointed at SAF going into Europe and the U.K. So, the PTC doesn’t really change what we were going to do strategically with that feedstock. And so, that’s our view as we’ll continue to run that into the SAF into the Europe and U.K. markets.”

-Eric Fisher (Valero, SVP Trading & Wholesale)

And you can see the partial bump up in non-RD domestic production but it is still not a significant increase to overcome the drop in domestic RD+Bio production.

Both Valero and P66 report RD margin indicators but they are still are including the $1/gallon Blenders Tax Credit (BTC). There is a shift to a Producers Tax Credit (PTC) but the Treasury Dept is taking their sweet time finalizing the guidelines. Not all feedstock receive the reduced value of the PTC, including imported Canola oil and Used Cooking Oil (UCO).

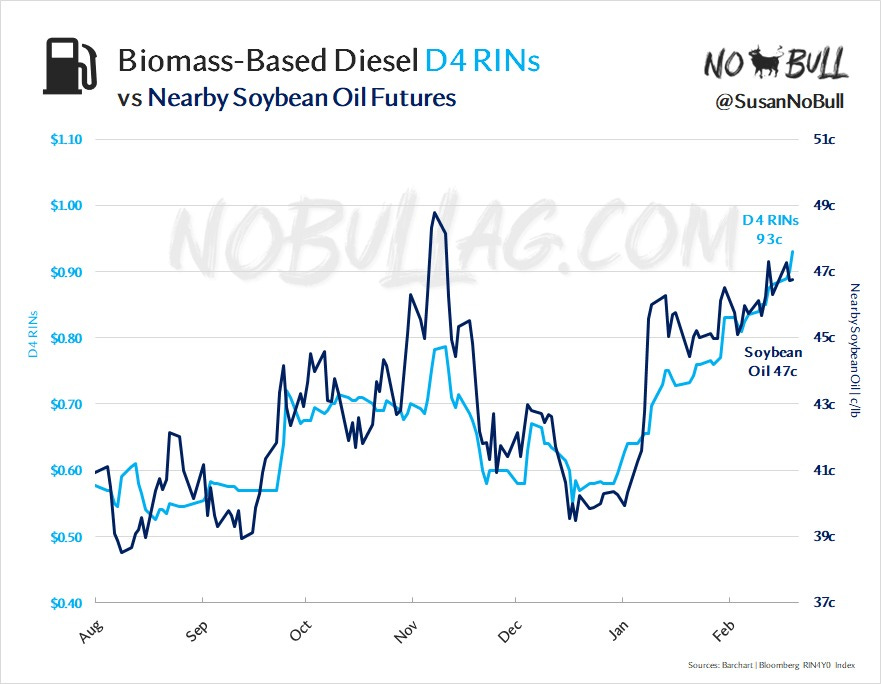

With margins being down, the cheapest feedstock on the market is currently Soybean Oil (SBO), which can receive the PTC. So what part of the margin equation can adjust to improve margins? Well feedstock prices can go down, or RINs can go up. Per Susan Stroud at NoBullAg, SBO has been climbing since the beginning of the year along with D4 RINs. With feedstock prices going up, margins are still squeezed. Do D4 RINs finally get back over the $1 threshold? Maybe.

Potential MAJOR Policy Changes in 2025

There are soooo many moving pieces to the Biofuel margin equation potentially making big changes in 2025, especially RD. Some expected, some not.

Tariffs: Nearly 30% of the feedstock to make RD + Bio (mainly RD) is imported into the US

2026+ Renewable Fuel Obligations (RVOs): what will the EPA set the RVOs? 10% of D6 obligation is fulfilled by D4.

Small Refinery Exemptions (SREs): will Trump 2.0 take a play from Trump 1.0 and hand out SREs like Halloween candy?

Inflation Reduction Act (IRA): will it go away? will it stay?

Low Carbon Fuel Standard (LCFS): will the 9% step-down go into effect or will CARB open back up the whole debate?

With so many policies impacting the economics of RD, I think it is safe to say 2025 is going to be a bumpy road to say the least.