RFS: RIN Generation Oct '24 Highlights

D3 Boom Continues, Shift to 45Z, China UCO Rebate, RIN Holdings, SRE's

October Gross RIN Generation

RIN generation in October rose by 2.44% vs September or 164 million RINs to 2,103 million RINs. And like in past months, September RIN generation was also revised upwards by 200 million RINs (Sep adjustment is taken into account in the analysis below).

D3 RIN gen: 83 million vs 95 million in Sep

D4 RIN gen: 784 million vs 767 million in Sep

D5 RIN gen: 20 million vs 27 million in Sep

D6 RIN gen: 1,268 million vs 1,213 million in Sep

Total RIN gen: 2,155 million vs 2,103 million in Sep

YoY growth in October was 2%, the lowest YoY growth on a percentage basis since 2020.

YTD gross RIN generation hit 20.85 billion RINs at the end of October, up 6.6% YoY. Over 97% of the growth has come from the D3 and D4 categories seeing a YoY growth of 156 million RINs and 1,092 million RINs, respectively.

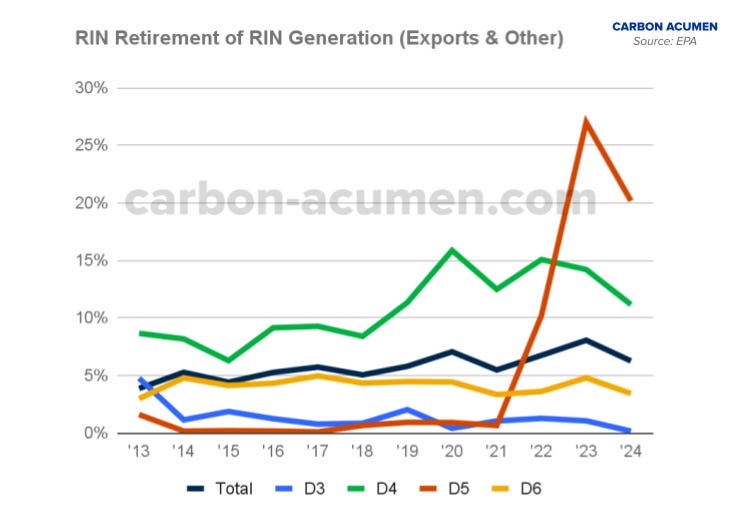

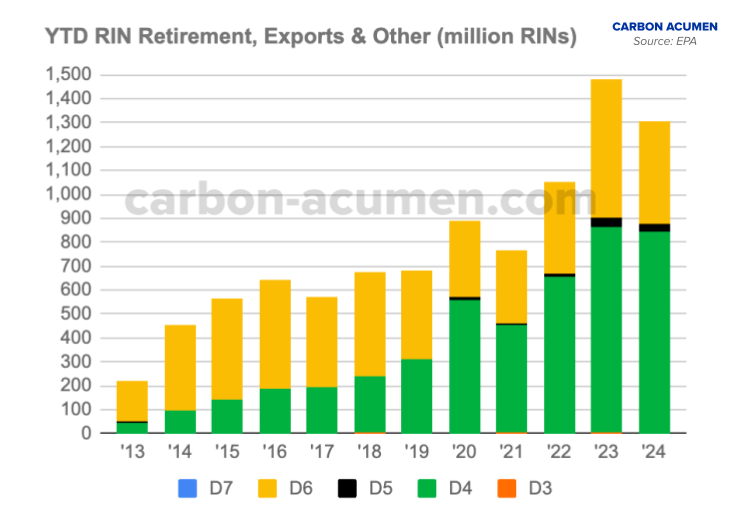

A reminder, just because RINs are generated it does not mean they are available for compliance due to the fuel being exported or used in other fuel applications not deemed eligible under the RFS. Over 6% of RINs generated are retired for these purposes.

RIN retirement is not equal across all D classes as D3+D6 RIN Retirement due to Exports & Other is below 5% of RIN generation, whereas RIN Retirement due to Exports & Other has been north of 10% for the past 5 years for D4 RINs and the past 3 years for D5 RINs.

Not all RIN generating fuel is consumed in the US (not shipped here or exported out of the country). YTD RIN retirement is actually down in the aggregate to 1.3 billion RINs driven by a YoY decrease of 200+ million D6 RINs (ethanol) and slightly lower D4 RIN Retirement.

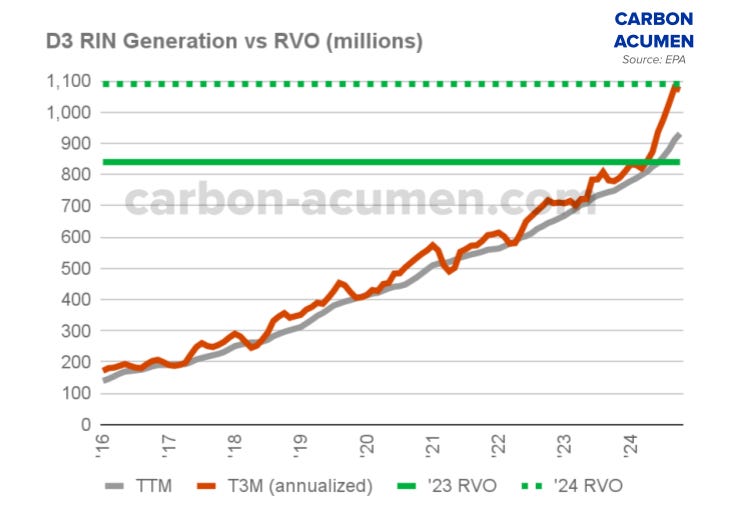

D3 to the Moon?

Its about time! For the longest time it seemed as if D3 RIN generation was tracking along the linear growth seen in the past 8 years but month-after-month of EPA revising upwards, D3 RIN generation is finally at the production levels needed to hit the 2024 RVOs.

LOOOOOKKK!!! Cellulosic ethanol is finally making some traction as October RIN generation for Cellulosic ethanol hit an all-time high of 6 million gallons or 6 million RINs.

Even though D3 RIN generation is finally at 2024 RVO production levels, it is the end of the year. Therefore if RIN generation in Nov+Dec follows the typical path in prior years, D3 RIN generation is looking to be short of the 2024 by 100+million RINs. Because of the this shortage, the EPA sent a partial waiver request for Cellulosic Biofuels to the White House OMB earlier in November.