The Illusion of the "RIN Cliff"

A deep dive into the nuances of RFS and Canada's need for Renewable Diesel

RINs, RINs, RINs!! No need for some glittery intro, let’s get into it.

D4, D5, D6 RIN prices have been slashed by 40% since the beginning of the year to around $1, while D3 RIN prices are back to where they started for the year, around $3.

Why?

RIN Cliff: the start

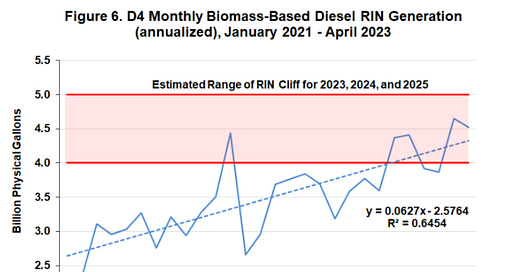

It all started with Farmdoc DAILY RIN Cliff article. Based on EPA RIN generation and their analysis of the preliminary ‘23-’25 RVOs set by the EPA, the authors signaled to their readers along with the respective market that the combination of biodiesel and renewable diesel production (D4 RIN generation) is already within their “RIN Cliff” range of 4-5 billion gallons annualized production as early as Q1 ‘23. Thus any new planned RD facility coming online in the back half of ‘23 would tilt the program into oblivion as production would far exceed demand.

RIN Cliff: revised down

After EPA released the ‘23-’25 Finalized RVOs, Scott Irwin estimated the “RIN Cliff” to hover around 4 billion gallons (seen in line (9)) for ‘23-’25.

RIN crash course of how to read the table below, it’s a little confusing at first:

RINs: Total (1) = Advanced (2) + Conventional (6)

RINs: Advanced (2) = Cellulosic (3) + Biomass Based Diesel (4) + Undifferentiated (5)

RINs: Conventional (6) = corn ethanol (1 RIN = 1 gallon)

D3 RINs + D4 RINs can cover D5 obligation (line (2))

D3 RINs + D4 RINs + D5 RINs can cover D6 obligation (line (6))

Gallons: Biomass Based Diesel (BBD) mandate (1.6 RIN/gallon)

Gallons: D3+D5 low generation = needs D4 to cover (line (7))

Gallons: D6 ethanol “blend wall” at 10% of gasoline = needs D4 to cover (line (8))

Gallons: 4 billion BBD gallons to cover BBD mandate + remaining RVO (line (9))

When will this “RIN Cliff” appear? Well according to Scott Irwin it should be about now.

RIN Cliff: repeated messaging

"The value of those credits could collapse if supply of renewable diesel and biodiesel overwhelms the demand implied by the EPA mandates, said Scott Irwin, an agricultural economist at the University of Illinois Urbana-Champaign. He estimated that threshold to be about 4 billion gallons a year.”

“When this condition is violated, our analysis indicates that the consequences for [biomass-based diesel] and RIN prices would be dramatic,” explains Gerveni, Irwin, and Hobbs. “The D4 biodiesel RIN price is predicted to fall to zero because no additional incentive beyond the competitive market price is needed to incentivize [biomass-based diesel] production. Literally, the D4 RIN price falls off a cliff.”

Bloomberg also expecting excess credits of 1.47 billion RINs or 900 million gallons of excess BBD through August.

Add in a couple of major conferences (Argus + OPIS) which includes attendees from all sectors (finance, traders, brokers, producers, NGOs, etc) and you start getting into a repeat & substantiate but don’t corroborate the claim at hand pattern, aka groupthink.

So here we are in September when the industry should be jumping off a cliff but RINs still have value.

Hhhhmmmm. Why?

CANADA!!! Oh yeah the RIN Cliff model excludes RD exports which EIA does not report, only EPA does via RIN retirements.

Alright let’s dig into Canada. Oh boy, liters…